January 3rd, 2025 Jesse Cramer

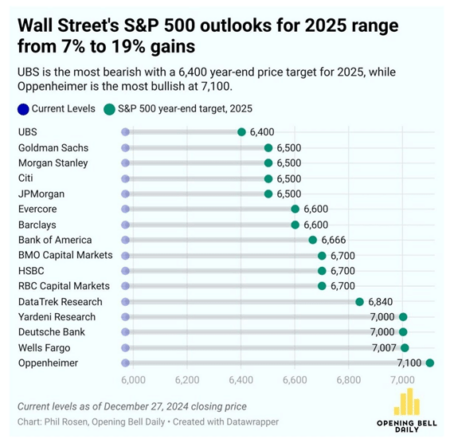

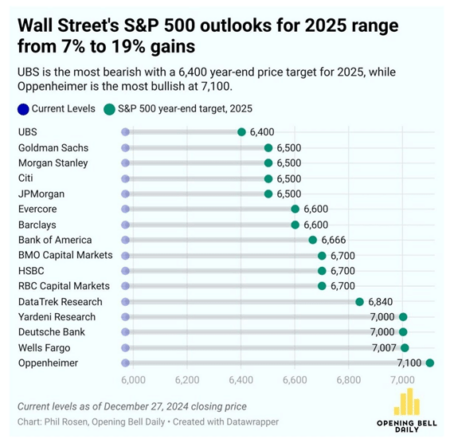

Have you heard this year’s version of Wall Street’s favorite joke? “We’re going to predict how the stock market does this year!“ Woof. Yikes. Why?! 1-year stock predictions are pointless. We’d all be better off accepting that fact. Risk, Reward, Timelines, and More Time and again, I want to ensure every long-term investor understands the […]

“If all you have is a hammer, everything looks like a nail.” We’ve all heard that phrase, alongside the concept of having “the right tool for the job.” I submit that many people in the retirement planning community (especially online in DIYer circles) do not have the right tools or mental models for including long-term […]

So far, it’s been a relatively good year for investors. Despite a brief correction in late July and early August, many sectors have performed well, with the tech industry continuing to lead the way. Now, with the Federal Reserve poised to lower interest rates, the outlook for bonds and bond funds over the next 12 […]

Over the last few years, we’ve witnessed widespread financial hardship and market volatility that’s left many retirees questioning the safety of their investments. The current economic climate is uncertain, to say the least. What we’re experiencing today isn’t, or at least shouldn’t be a shock or surprise. Inflation and recession and the rise and fall […]

The economy expanded smartly in the years before the Great Recession, just as it did before the COVID downturn. But the two recessions were markedly different, with opposite effects on when older workers signed up for Social Security, a new study finds. In 2008, the stock market slid nearly 40 percent. Older Americans with retirement […]