March 12th, 2025 Elliot Kallen

Understanding the Economic Impact of Tariffs Trade policies—especially tariffs—have been a major topic of discussion recently. Regardless of political perspectives, these policies can significantly impact industries, markets, and investment strategies. The goal of this article is to explore how tariffs have shaped the U.S. economy and what they mean for the future of American manufacturing […]

The constant rise in inflation rates is troubling a majority of Americans, who have started to question their financial goals, especially the ones relying on Social Security benefits. With more than 7.25 million Americans benefiting from Social Security and Supplemental Security Income (SSI), the recent changes announced by The Social Security Administration (SSA) came as […]

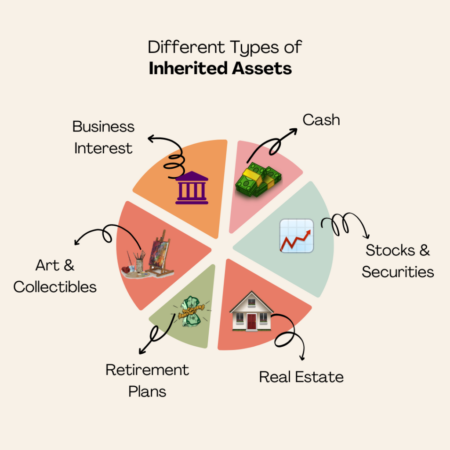

Inheriting money, especially during a loss, can be overwhelming, with so many emotions to process. On average, people inherit around $46,200 in their lifetime, though that figure can vary widely depending on your family’s estate. Although inheritance may offer a sort of financial support for some, receiving a large sum of money while still mourning […]

Arguably, winning the lottery is everyone’s dream. With the odds of hitting the Powerball at approximately 1 in 292 million and the Mega Millions at around 1 in 302 million, it’s clear that you’re more likely to become President of the United States or be struck by a meteorite than to hit the jackpot. The […]

It’s a common question we get as financial professionals: what are the financial advantages of getting married? When two people decide to tie the knot, it’s often seen as the start of a new chapter filled with love, partnership, and shared dreams. However, marriage can have a big impact on a couple’s financial situation, especially […]

So far, it’s been a relatively good year for investors. Despite a brief correction in late July and early August, many sectors have performed well, with the tech industry continuing to lead the way. Now, with the Federal Reserve poised to lower interest rates, the outlook for bonds and bond funds over the next 12 […]

We are all aware of the 4th of July when we celebrate American Independence, the Declaration of Independence, the Bill of Rights, and the inspiring phrase, “Life, Liberty and the Pursuit of Happiness.” This phrase is one of the cornerstones of our daily lives here in this great Republic. Travel around the world, and you’ll […]

As we enter the second half of 2024, an election year with all types of volatility, we should continue to think about where we desire our wealth to go, while we are still alive or post-death. Planning here is always advantageous, or we may be giving the state and federal governments a large bulk of […]

I am quite sure you have no idea what I am talking about. Even if you aren’t the shopper in the family or would never purchase frozen peas or corn, why is this relevant to bond accounts? Experts predicted that the Federal Reserve Bank would lower interest rates at least three times this year, beginning […]

What kind of son would I be if I didn’t pen a mushy, heartfelt note this Mother’s Day? Today, and indeed every day, is a perfect opportunity to acknowledge the extraordinary efforts our mothers put into raising us. They endured sleepless nights during our early years, managed countless diaper changes, nursed us through illnesses, constantly […]