- 68. Spotting Red Flags in Syndication Documents feat. Dugan Kelley Aspen Funds 41:33

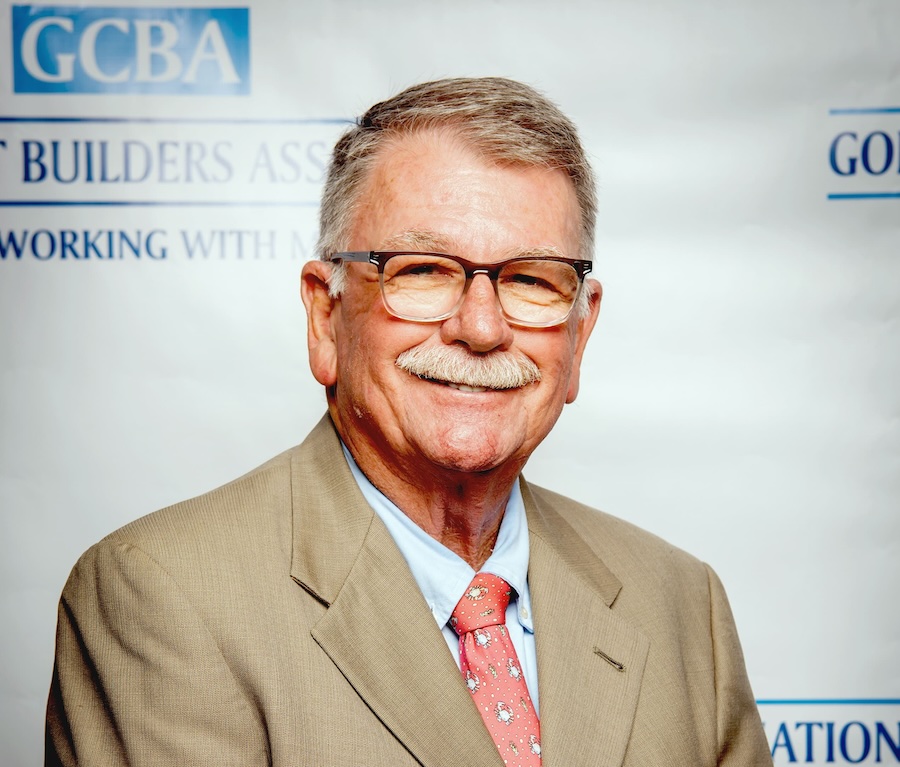

Have you ever received the legal documents for a syndication and been unsure of what to look for? The legal documents are a foundational component of syndications, but understanding them and being able to spot red flags are critical skills. In this week’s episode, co-hosts Bob and Ben Fraser are joined by Dugan Kelley, a top SEC Attorney, who has overseen $5B worth of transactions. Watch this week’s episode to learn how to read and understand the legal docs and especially the red flags to watch out for.

Get started and download your free economic report today at https://aspenfunds.us/report

Read the full transcription https://aspenfunds.us/podcast/spotting-red-flags-in-syndication-documents-feat-dugan-kelley/

Connect with Dugan on LinkedIn – https://www.linkedin.com/in/dugan-kelley-0019b435/

Invest Like a Billionaire podcast is sponsored by Aspen Funds which focuses on macro-driven alternative investments for accredited investors.

Learn More about Aspen Funds.

https://www.aspenfunds.us

Join the Investor Club to get early access to exclusive deals.

https://www.aspenfunds.us/investorclub

Subscribe on your favorite podcast app, so you never miss an episode.

https://www.thebillionairepodcast.com/follow

Rate us! We really appreciate your feedback and support.

https://www.thebillionairepodcast.com/reviews/new/

Ask Anything! We’d love to hear what’s Top of Mind.

https://www.thebillionairepodcast.com/contact

Already a Member? Login Here.

Not Yet a Member? Join the Conversation Today!