Here’s How To Determine If You Should Keep Or Break Up With Your Advisor

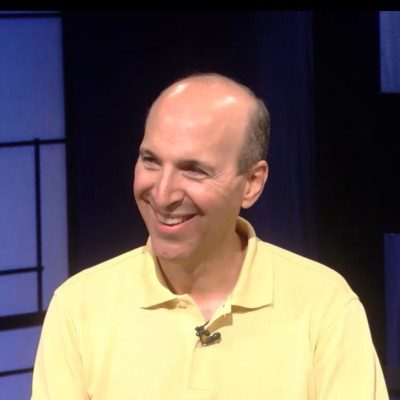

- Here’s How To Determine If You Should Keep Or Break Up With Your Advisor Ari Taublieb, CFP®, MBA 29:29

Create Your Custom Early Retirement Strategy Here

Get access to the same software I use for my clients and join the Early Retirement Academy here

Is your financial advisor truly meeting your needs, or is it time for a change? In this episode, we tackle the tough decision of when to fire your financial advisor. Learn from personal stories, including my parents' own experiences with suboptimal guidance, and uncover the critical factors you need to consider—like expert tax planning and specialized early Retirement strategies. We also break down the logistics of transferring your assets smoothly and emphasize why lining up a new advisor before making any changes is crucial. Spotting red flags, such as an advisor who never asks for your tax return, is just one of the practical tips we share to help you make an informed decision.

Understanding the key differences between tax preparers and financial advisors is essential for your financial strategy. We'll discuss why integrated tax planning is a must and explore the importance of a clear succession plan for your advisor to ensure continuity and trust. Long-term Relationships and manageable client loads are vital for sustained success, and we highlight these aspects in our conversation. Finally, we dive into the value of detailed financial planning for retirement and the necessity of fee transparency, demonstrating how justified fees can boost your confidence in your retirement plan. If you're contemplating a change or just seeking better financial advice, this episode is packed with insights to guide your journey.

Create Your Custom Early Retirement Strategy Here

Get access to the same software I use for my clients and join the Early Retirement Academy here

Ari Taublieb, CFP ®, MBA is the Vice President of Root Financial Partners and a Fiduciary Financial Planner specializing in helping clients retire early with confidence.